SAP S/4HANA Finance solutions

Transform complex financial operations into streamlined, insight-rich workflows that empower strategic execution.

Finance of the future with SAP S/4HANA solutions

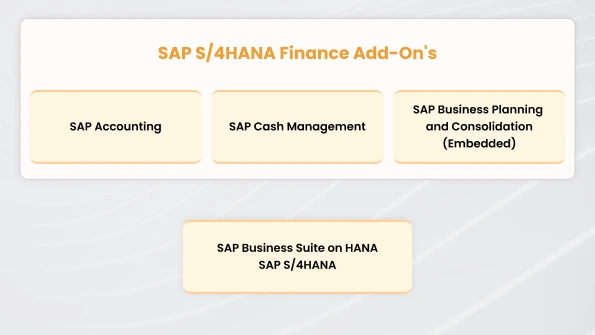

SAP S/4HANA Finance, sometimes referred to as SAP S/4 Finance or SAP Simple Finance, is the next generation of SAP S/4HANA FI/CO. It is based on three pillars:

SAP Accounting

Transaction data can be analyzed across applications, with the account as the key element in Finance and Asset Accounting.

SAP Cash Management

Planned or previously accounted for finance data can be used to assess liquidity evaluations.

Integrated planning

The components of Business Planning and Consolidation (BPC) make it possible to register and process planned and forecast values directly in the SAP ERP.

Features boosting next-gen financial management

A complete financial management solution designed to streamline financial procedures, provide real-time information, and assist with advanced financial analytics.

- General Ledger (GL) Accounting

-

Accounts Payable (AP) and

Accounts Receivable (AR) - Asset Accounting (AA)

-

Bank Account Management

(BAM) -

Cash Management and Bank

Communication -

Financial Planning and

Analysis (FP&A) -

Financial Closing and

Consolidation

General Ledger (GL) Accounting

General Ledger Accounting serves as the central repository for all financial transactions within an organization.

Document splitting

Enables businesses to produce comprehensive financial statements at different levels.

Parallel accounting

Organizations can keep several ledgers for several accounting rules (such as IFRS and GAAP) at the same time.

Extension ledgers

Add custom fields and tables to the general ledger so that organization-specific data can be included.

Real-time financial reporting

Financial data is instantly accessible, enhancing decision-making and eliminating batch processing.

Accounts Payable (AP) and Accounts Receivable (AR)

Better financial control, consistent cash flow, and on-time payments are all ensured by AP and AR management.

Vendor and customer account management

Simplify the process of creating and maintaining master data for customers and vendors

Payment processing

Automates the entire payment process, including runs, bids, and tracking.

Credit management

Establishes credit limits, risk classifications, and client credit scores to control credit risk.

Collections and dispute resolution

Offers resources for effective handling of past-due accounts, client reminders, and dispute settlements.

Asset Accounting (AA)

Asset Accounting (AA) of financial accounting manages a company’s fixed assets throughout its lifecycle.

Integrated depreciation engine

Supports multiple stages and straight-line depreciation techniques and calculation rules.

Periodic processing

Enables regular asset accounting activities, including asset history sheet reporting and asset revaluations.

Capital work in progress (CWIP)

Manages the settlement and capitalization of construction-related assets.

Asset retirements, scrapping, and transfers

Manages a range of asset lifecycle activities, such as scrapping and business area transfers.

Bank Account Management (BAM)

Bank Account Management (BAM) provides centralized control over a company’s bank accounts, enabling efficient setup.

Centralized account management

Provides all bank accounts a point of control, enabling the opening, closing, and modification of account information.

Bank account signatories

Manages signatory information changes and approval processes for bank account signatories.

Audit trail

Maintains a complete record of every change made to bank account data.

Cash Management and Bank Communication

Cash Management and Bank Communication enable real-time visibility and control over banking activities.

Cash positioning

Combining transaction data and bank account balances, it offers real-time visibility into cash situations.

Cash flow forecasting

Using historical data and predictive analytics, make both short- and long-term cash flow projections.

Bank communication management

By supporting standardized formats, bank communication management simplifies interactions with banks.

Financial Planning and Analysis (FP&A)

Financial performance analysis, forecasting, and budgeting are the primary goals of financial planning and analysis, or FP&A.

Forecasting and budgeting

Support in the development and administration of forecasts and budgets at different levels of detail.

Profitability analysis

Tools for evaluating profitability at different levels, such as consumers, products, or market segments.

Integration with SAP Analytics Cloud

Generates extensive financial reports by utilizing SAP Analytics Cloud’s powerful analytics features.

Financial Closing and Consolidation

Streamlines the process of finalizing financial statements and combines financial data from multiple entities.

Closing Cockpit

Provides an established dashboard for managing and tracking closing tasks, schedules, and dependencies.

Intercompany reconciliation

Automates intercompany transactions, balances, and eliminations.

Group reporting

Facilitates the preparation of consolidated financial statements in compliance with different accounting standards.

Insights that drive transformation

60%

Tasks related to traditional finance are increasingly automated.

72%

CFOs have a final word on the company’s technological orientation.

68%

CFOs say finance is ultimately in charge of ESG performance.

60%

Tasks related to traditional finance are increasingly automated.

72%

CFOs have a final word on the company’s technological orientation.

68%

CFOs say finance is ultimately in charge of ESG performance.

Modernize your financial processes with a future-ready platform that offers predictive insights, streamlined workflows, and unmatched integration across business functions.

Key benefits of SAP S/4HANA finance for enterprises

Empower company productivity with intelligent automation, minimized processes, and real-time analytics.

Simplified Financial Processes

SAP S/4HANA migration for finance automates financial processes to streamline operations, reduce manual effort, and boost efficiency.

Universal Journal

Unifies financial data into a single source of truth, enabling real-time analysis and eliminating redundancies.

Real-time Reporting

Enables real-time financial reporting, giving stakeholders instant insights into performance.

Integrated Risk and Compliance

The solution embeds risk and compliance tools to monitor financial risks and ensure regulatory adherence.

Predictive Analytics

Predictive analytics are implemented by SAP S/4HANA Finance for data-driven decision-making and advanced forecasting.

Frequently asked questions

What is the Universal Journal in SAP S/4HANA Finance? +

The Universal Journal consolidates financial, controlling, and asset accounting data into a single table, providing a unified source of truth. This eliminates data redundancy and enables faster, real-time reporting and analytics.

How does SAP S/4HANA Finance improve financial closing processes? +

It automates and accelerates period-end closing by integrating data across modules, reducing reconciliation efforts, and enabling continuous close processes. This results in faster, more accurate financial statements.

Can SAP S/4HANA Finance help with regulatory compliance? +

Yes. It includes built-in governance, risk, and compliance (GRC) features that help organizations enforce policies, monitor financial risks, and meet both global and industry-specific regulatory standards.

How does predictive analytics work in SAP S/4HANA Finance? +

The solution uses machine learning and predictive algorithms to generate accurate forecasts, simulate financial scenarios, and support strategic planning with data-driven insights.

What choices are available for SAP S/4HANA Finance deployment? +

SAP S/4HANA Finance can be deployed on-premise, in the cloud, or in a hybrid environment, depending on an organization’s needs, IT strategy, and scalability requirements.

Transform your finance operations today

Unlock the power of SAP S/4HANA financial accounting to streamline your financial operations and make smarter decisions.

Explore related business solutions

From strategy to execution, find the perfect solution to accelerate your journey toward success.

Talk to an expert

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)